AI Spending and Earnings: Key Growth Engines

A central theme for 2026 is continued corporate investment in technology and AI. Major tech companies like Alphabet, Amazon, Meta, Microsoft, and Oracle are expected to contribute significantly to the sector’s momentum. Jeff Buchbinder, chief equity strategist at LPL Financial, notes AI capital expenditures could reach around $520 billion next year, helping to sustain optimism in growth stocks. CBS News

However, not all tech gains are moving in lockstep: recent market action showed uneven performance within the tech sector, with some companies outperforming while others lagged, reflecting a nuanced investor view of AI’s long-term payoff. CBS News

Interest Rates and Market Dynamics

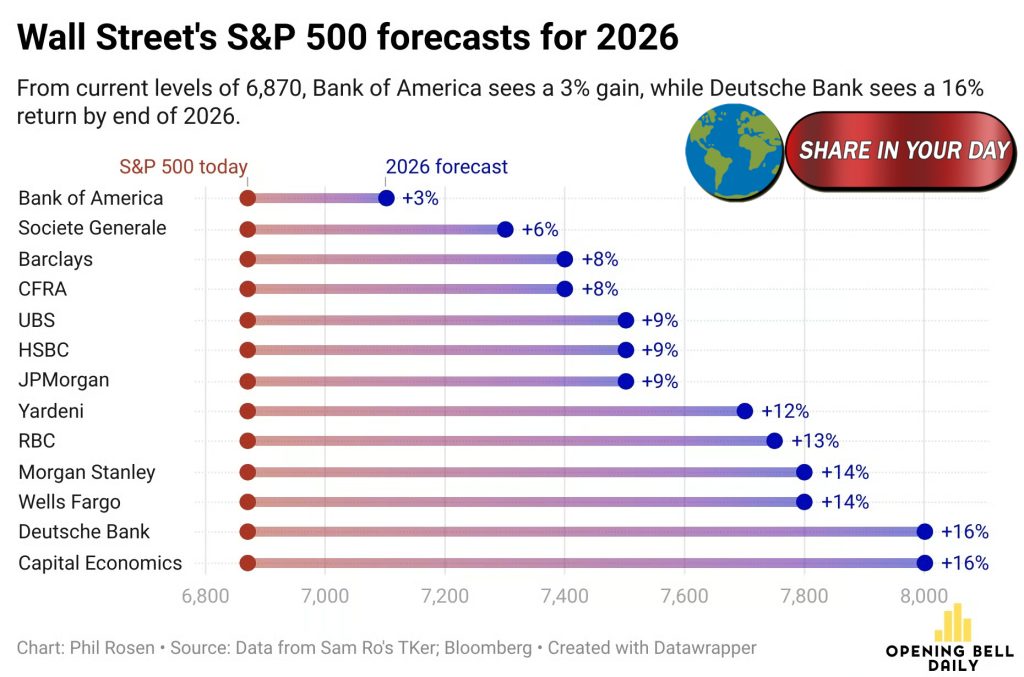

Market outlooks for 2026 also factor in expectations around monetary policy. While some analysts forecast further interest rate cuts early in the year, others expect a pause after limited easing. For example, a J.P. Morgan report cited a potential rate cut followed by an extended pause, a scenario that could help lift major indexes, with some forecasts placing the S&P 500 above 8,000 by year-end if conditions align. CBS News

Despite the overall optimism, analysts caution that market volatility will remain a factor. After multiple consecutive months of growth, minor pullbacks or periods of flat trading are possible as investors balance lofty valuations with evolving economic data. CBS News

Investor Takeaways for 2026

- Earnings growth is expected to be a primary driver of stock market gains next year, especially among large corporations and technology firms. CBS News

- AI investment remains a central theme, though performance within tech may vary company by company. CBS News

- Interest rate expectations and Federal Reserve actions will continue to influence market sentiment and equity valuations. CBS News

- Market participants should prepare for periodic volatility, even within a broadly positive outlook. CBS News

As 2026 approaches, investors and financial professionals alike are positioning portfolios to reflect both the opportunities and risks inherent in a market shaped by earnings dynamics and technological transformation.

If you’d like sector-specific outlooks or analyst target projections (e.g., S&P 500 range forecasts) to include in this article, just let me know