Why Gold Prices Hit Record Highs — and Why They’ve Suddenly Pulled Back

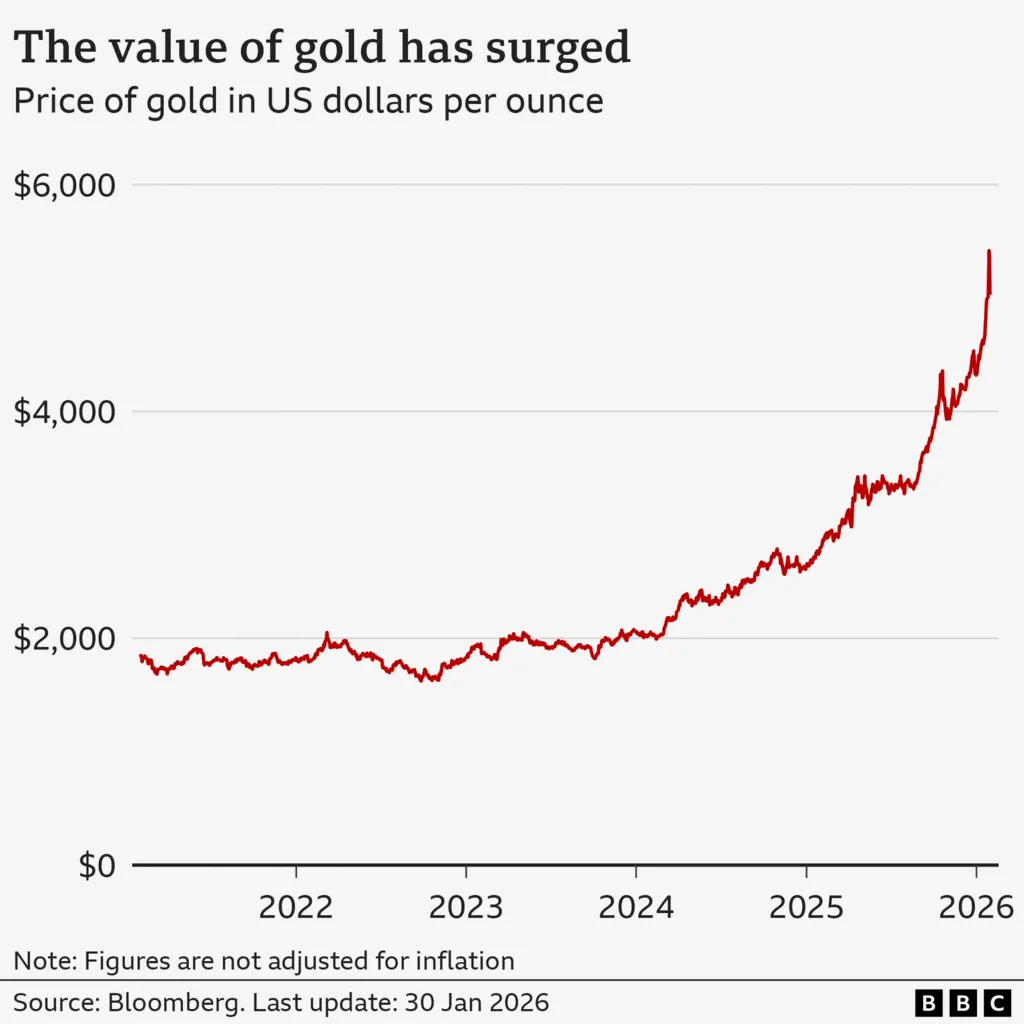

Gold prices have surged to unprecedented levels in recent weeks, underscoring investors’ growing unease over global politics, trade disputes and the future direction of the US economy.

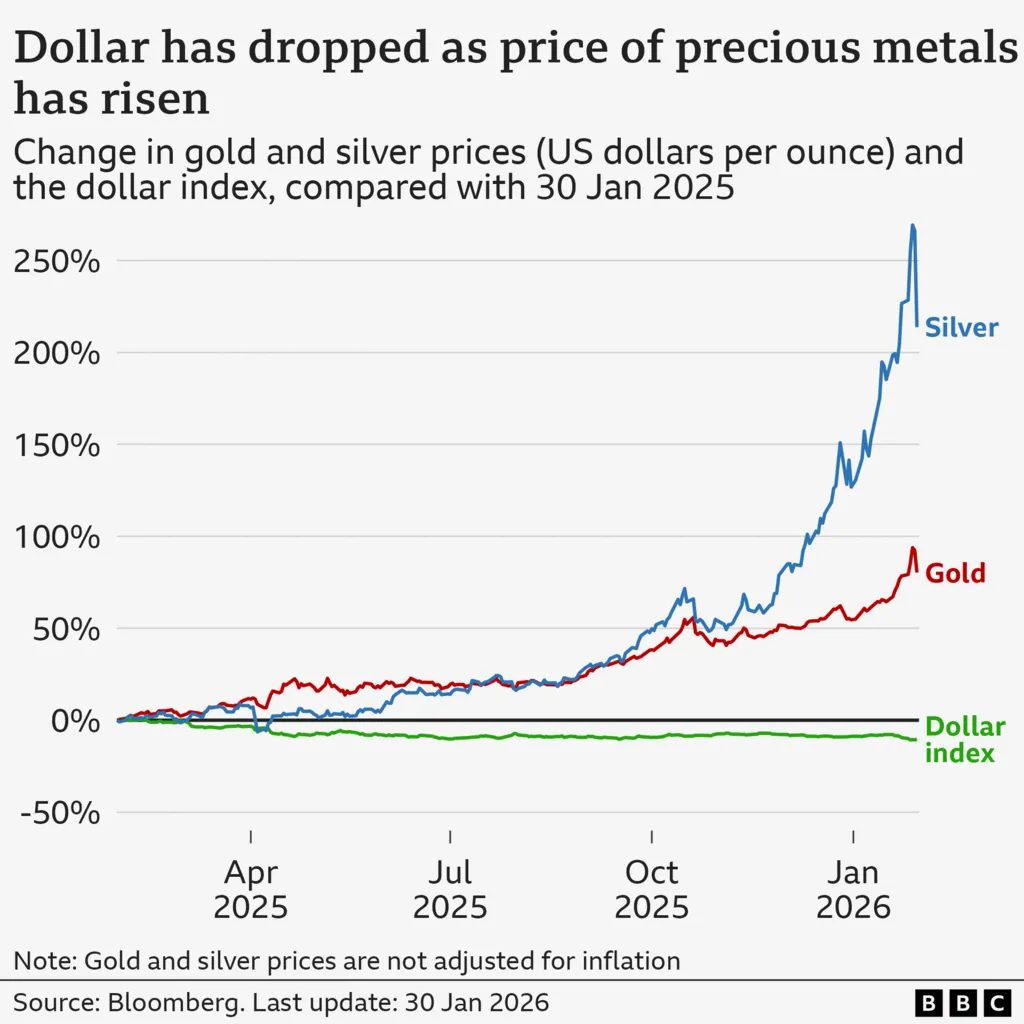

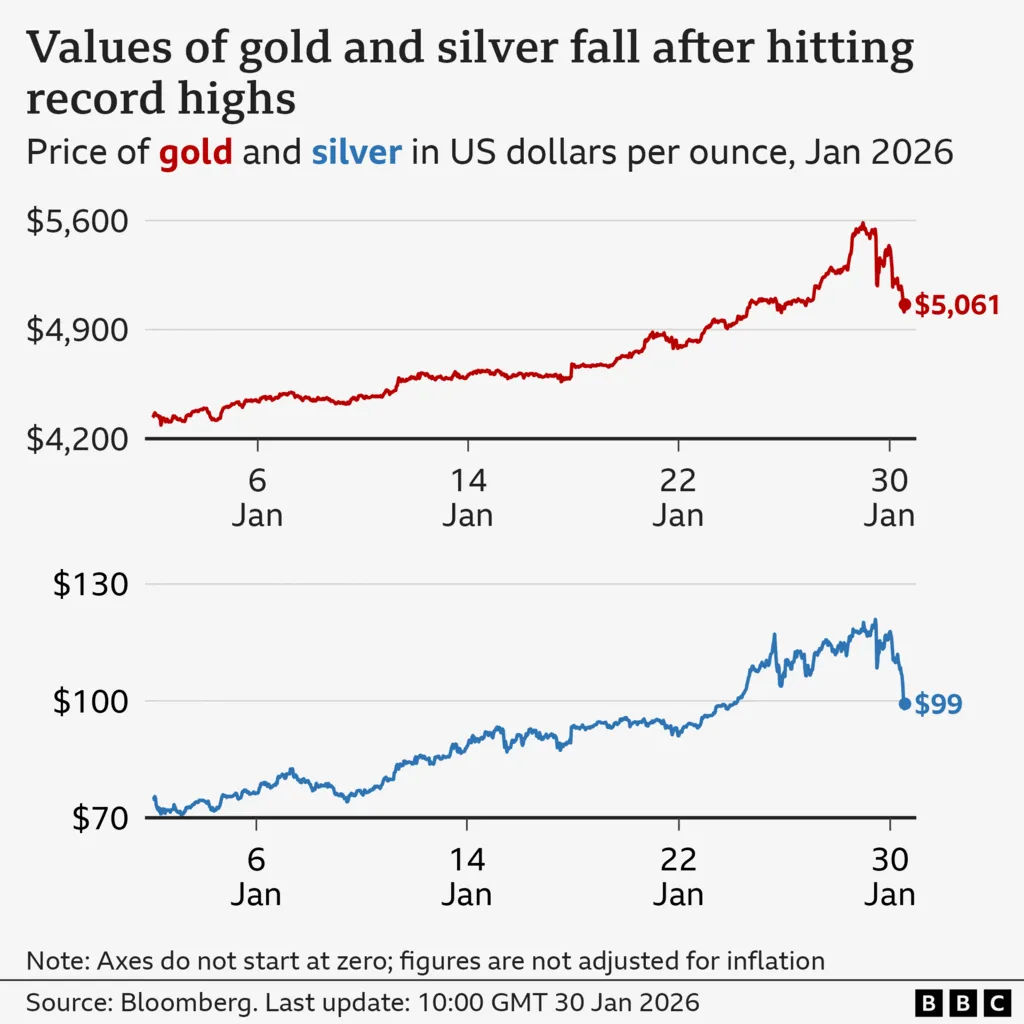

The precious metal briefly vaulted above $5,000 an ounce earlier this week — a symbolic milestone for a commodity long viewed as a refuge in times of uncertainty — before touching $5,500 at its peak. Silver and platinum followed a similar upward trajectory.

But the rally proved fragile. Prices across precious metals have since retreated sharply, triggered by signs of political stabilisation in the United States. Even so, gold remains significantly higher than it was a year ago, reflecting deeper forces reshaping global investment behaviour.

Analysts point to three key drivers behind gold’s historic rise, and one critical reason for its sudden pullback.

1. Trump’s Trade Policies and Investor Anxiety

At the heart of gold’s surge lies renewed uncertainty surrounding US trade policy under President Donald Trump, whose return to office has rattled global markets.

Trump has reintroduced sweeping tariffs on countries he deems unfavourable trading partners, unsettling investors and disrupting global trade flows. His administration’s unpredictable approach has revived fears of retaliatory tariffs, inflationary pressures and slower economic growth.

“Gold and silver prices hit record highs as investors reacted to the renewed threat of tariffs,” said Emma Wall, chief investment strategist at Hargreaves Lansdown.

Earlier this year, equity markets faltered after Trump threatened new tariffs on several European countries opposing his controversial proposal to take control of Greenland. As stocks slid, capital flowed rapidly into gold — a familiar pattern during periods of political stress.

According to Hamad Hussain, economist at Capital Economics, gold has benefited from its long-standing reputation as a hedge against policy risk.

“Concerns over US foreign and fiscal policy have put gold firmly in the spotlight,” Hussain said, particularly as investors reassess the stability of the dollar under Trump’s leadership.

2. War, Geopolitical Tensions and the “Greenland Effect”

Beyond Washington, a deteriorating global security landscape has amplified gold’s appeal.

Ongoing wars in Ukraine and Gaza continue to weigh on investor sentiment, while fresh geopolitical shocks — including the US seizure of Venezuelan President Nicolás Maduro — have added to market unease.

Trump’s repeated threats over Greenland further heightened tensions, eroding confidence in US diplomacy and prompting investors to seek safety outside traditional currencies.

The dollar suffered one of its steepest declines during Trump’s presidency following the announcement of his so-called “Liberation Day” tariffs last spring. That drop coincided with a sharp surge in gold buying.

“Gold is doing what it does best when the world feels messy,” Wall said.

“Trade tensions, geopolitical flare-ups and political uncertainty in the US have all boosted its appeal.”

Fresh friction between the US, China and Canada, alongside instability in Europe and the Middle East, has reinforced the perception that global risks are multiplying rather than receding.

3. Central Banks Are Buying — Big Time

Perhaps the most powerful force behind gold’s rise has been sustained buying by central banks, particularly since 2022.

“Global central banks have increasingly favoured gold as a reserve asset,” Wall said, citing concerns over dependence on US monetary policy.

Some countries, she added, took note when Russia’s dollar-denominated assets were frozen by Western governments following its invasion of Ukraine — prompting a reassessment of gold as a politically neutral store of value.

While central bank demand remains elevated compared with pre-2022 levels, Hussain notes there are signs that purchases may have softened in 2025.

Still, demand remains strong across other segments of the market.

China continues to be the world’s largest gold buyer, driven by both consumer demand for jewellery and investment purchases. Western investors have also poured money into gold-backed funds and companies involved in gold trading and storage.

New entrants have amplified the surge. One notable example is Tether, a digital currency firm that has accumulated such large gold reserves that they reportedly rival those of smaller national economies.

Why Gold, Silver and Platinum Suddenly Fell

Despite its powerful rally, gold’s pullback in recent days highlights the metal’s sensitivity to shifting expectations.

Prices surged partly on fears that Trump would appoint a Federal Reserve chair willing to cut interest rates aggressively — a move that could weaken the dollar and fuel inflation, conditions typically favourable for gold.

But those fears eased after reports suggested Trump would nominate Kevin Warsh, viewed by markets as a comparatively steady and orthodox choice.

As confidence in monetary policy stability returned, gold, silver and platinum prices all fell sharply.

Even so, analysts caution against interpreting the drop as a reversal of gold’s broader trend.

Prices remain well above last year’s levels, supported by ongoing conflicts, existing tariffs, fresh trade threats and persistent geopolitical risk.

Scarcity and Safety Still Shine

One of gold’s enduring strengths is its scarcity — and its independence from government debt or corporate performance.

“When you own gold, it’s not attached to the debt of somebody else,” said Nicholas Frappell, global head of institutional markets at ABC Refinery.

“It’s a really good diversifier in a very uncertain world.”

Still, Friday’s sharp swings serve as a reminder that gold is not immune to volatility. Like all traded commodities, its price can fall as quickly as it rises.

For now, though, the forces that pushed gold to record highs — uncertainty, geopolitical risk and shifting global power dynamics — remain firmly in place, ensuring the metal’s role as a financial safe haven is far from diminished.