Dow Futures Slide Amid Oracle AI Fears, Tesla’s Budget Model Y Raises Eyebrows

U.S. stock futures opened lower today as investors wrestled with mounting concerns over artificial intelligence developments from Oracle and a surprise move by Tesla to introduce a lower-cost Model Y variant.

Oracle’s latest AI initiatives have triggered market jitters, as analysts debate whether its technology push may disrupt existing players or amplify competitive risks. On the flip side, Tesla’s announcement of a “cheap” Model Y has raised questions about margins, brand positioning, and the potential ripple effects across the auto sector.

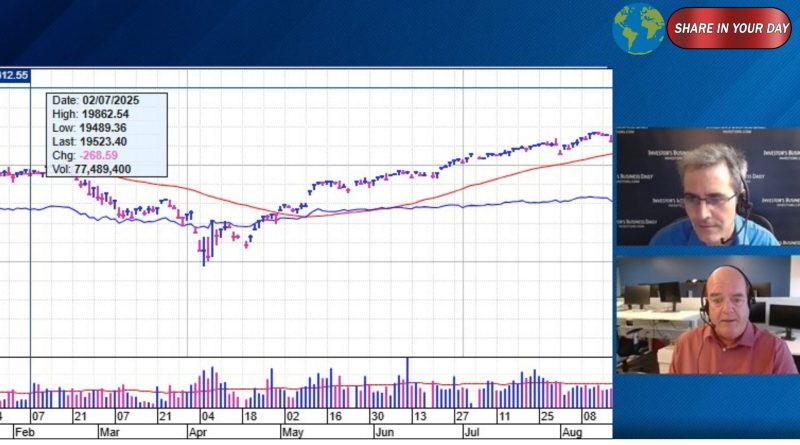

Markets Under Pressure

With sentiment already fragile, the Dow Jones futures tumbled as traders gauged how these developments might reshape earnings prospects for tech and auto names. Broader indexes are under the spotlight, with watchers monitoring whether this leads to a rotation away from high-growth, AI-adjacent stocks.

Oracle’s AI Gambit

Oracle’s unveiling of new AI capabilities has sparked both excitement and concern. While the move could position it as a more formidable contender in enterprise cloud and AI infrastructure, rivals may see it as a threat. The market is now parsing whether Oracle’s investments can scale profitably, or whether the aggressive push will intensify competition and compress margins across the board.

Tesla’s Affordable Model Y Shift

Tesla’s decision to launch a more affordable version of its Model Y has surprised many. While it opens the brand to a wider audience, it also raises alarms about how cost-cutting may impact quality, margins, and the eventual competitive response from other automakers. Analysts are dissecting how this might influence Tesla’s long-term brand value.

What to Watch Going Forward

- Earnings guidance from key tech firms and automakers

- How rival AI firms respond to Oracle’s move

- Consumer reception and sales figures for Tesla’s new Model Y

- Whether the equity rotation accelerates in favor of more defensive or value sectors