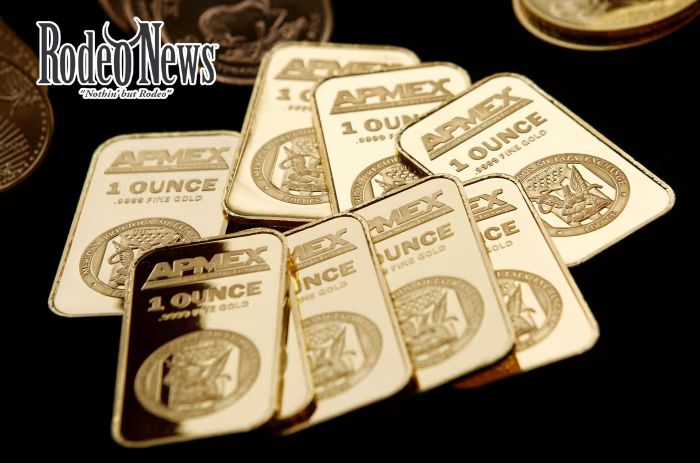

Gold and Silver Hit Record Highs in 2025 as Geopolitical Tensions Escalate

Global markets witnessed another dramatic surge in precious metals on December 22, 2025, as both gold and silver climbed to all‑time highs amid intensifying geopolitical tensions and growing expectations of U.S. interest rate cuts. Reuters+1

Safe‑Haven Demand and Market Dynamics

Gold, traditionally viewed as a hedge against uncertainty, surpassed $4,400 per ounce for the first time, reflecting strong investor appetite for safe‑haven assets. Spot gold briefly touched a fresh all‑time peak before settling slightly lower, while futures also tracked higher levels. Silver followed closely behind, breaking past $69 per ounce, its highest level on record. Reuters

Analysts point to several market drivers in this rally:

- Escalating geopolitical risk: Tensions involving key global actors and renewed conflict concerns have made investors increasingly risk‑averse, boosting demand for non‑yielding assets like gold and silver. Anadolu Ajansı

- Interest rate bets: Traders are pricing in multiple U.S. Federal Reserve rate cuts in 2026, a shift that typically supports precious metal prices by lowering real yields and weakening the dollar. Reuters

- Central bank activity: Continued purchases by international central banks have added structural support to bullion prices, reinforcing long‑term demand. Investing.com

Broader Market Impacts

The record‑setting prices for gold and silver came alongside strength in other metals markets. Platinum and palladium also climbed, with platinum reaching multi‑year highs. Traders noted that seasonal trends and lower year‑end liquidity may have amplified the moves, while technical breakouts above key resistance levels suggested the uptrend could persist. Reuters

Despite the rally’s momentum, market strategists caution that profit‑taking and thin holiday trading conditions may introduce short‑term volatility before year‑end. Reuters

What This Means for Investors

For investors, the 2025 precious metals surge underscores the enduring appeal of gold and silver as portfolio hedges during periods of geopolitical and macroeconomic uncertainty. With expectations for easier monetary policy and ongoing global tensions, markets will be watching how central bank decisions and international developments shape prices into 2026.