Stellantis Unveils $13 Billion U.S. Investment, Shifts Focus Away From EVs

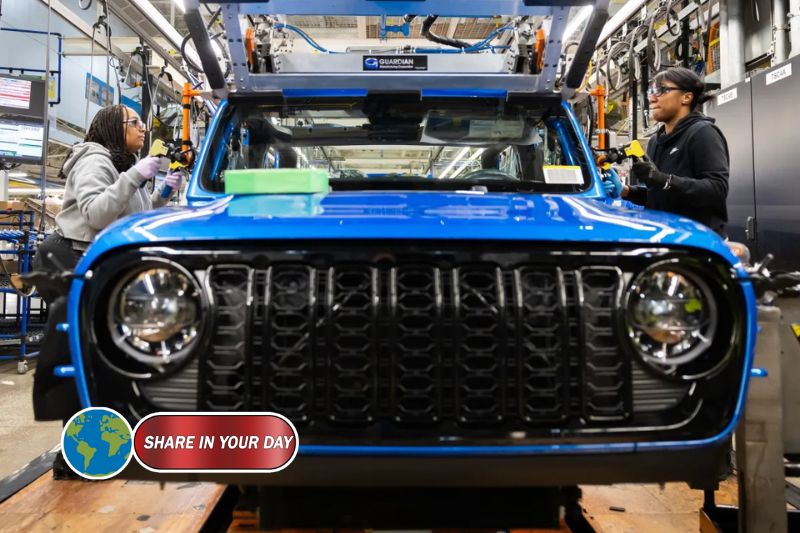

DETROIT, Michigan — International automaker Stellantis, the parent company of Jeep, Chrysler, and Ram, announced a massive $13 billion investment into its U.S. operations, signaling a renewed focus on traditional vehicles and internal combustion technology — not electric vehicles — over the next four years.

The investment, which will target key manufacturing hubs across Illinois, Ohio, Michigan, and Indiana, marks a significant pivot in Stellantis’ North American strategy under its newly appointed CEO, Antonio Filosa.

The funds will support the development of five new vehicles through 2029, the launch of a new four-cylinder engine, and the reopening of the long-idled Belvidere Assembly Plant in Illinois — a move expected to generate more than 5,000 new jobs.

Belvidere Reopens, Jeep Models Return

A key highlight of the announcement is the revival of the Belvidere Assembly Plant, which will once again produce Jeep Cherokee and Jeep Compass SUVs for the U.S. market. The plant had been shuttered amid declining demand and shifting market priorities, but its reopening now signals confidence in the sustained appeal of gas-powered and hybrid SUVs.

“Our goal is to drive growth and strengthen our industrial footprint here in the U.S.,” said Stellantis CEO Filosa in a statement. “Success in America is not just good for Stellantis in the U.S. — it makes us stronger everywhere.”

New Vehicles and Gas Engines Take Priority

The investment includes a slate of new vehicle development plans:

- A new gas-powered SUV and a range-extended electric vehicle (EV) — a hybrid model that uses a gas generator to extend battery range — will be produced at the Warren Truck Assembly Plant in Michigan beginning in 2028.

- A next-generation Dodge Durango is set to be built at the Detroit Assembly Complex by 2029.

- A new midsize pickup truck will be manufactured at the Toledo Assembly Complex in Ohio.

- A next-gen four-cylinder engine, named GMET4 EVO, will enter production in 2026 at Stellantis’ Kokomo, Indiana facility.

Despite recent trends favoring full battery-electric models, the majority of these products are gasoline-powered or hybrid — a noticeable shift in strategy as the company moderates its EV ambitions.

Scaling Back on Electrification

This $13 billion move comes just months after Stellantis scaled back several of its U.S. electrification projects. In September, the automaker canceled plans for an electric Jeep Gladiator and dropped its earlier commitment to build a battery-electric full-size pickup.

Stellantis still intends to bring a range-extended version of the Ram 1500 REV to market — a model formerly known as the Ramcharger — but its revised roadmap prioritizes flexible drivetrain solutions over full EV commitment.

The company’s cautious EV approach diverges from competitors like Ford and GM, which continue investing heavily in electric platforms. Instead, Stellantis appears to be hedging bets as U.S. EV demand slows and infrastructure challenges persist.

Strategic Focus on Job Creation and Domestic Growth

In addition to vehicle production, the plan emphasizes domestic job creation, a theme strongly echoed in Filosa’s comments.

“Accelerating growth in the U.S. has been a top priority since my first day,” the CEO noted. “This investment helps us do that by bringing more American jobs to the states we call home.”

Stellantis, formed from the 2021 merger between Fiat Chrysler and France’s PSA Group, has faced ongoing pressure to clarify its EV stance and U.S. growth strategy. This latest move signals a pragmatic approach rooted in market demand, job creation, and hybrid solutions — rather than an all-in leap toward electrification.